DISCLAIMER: The content provided in this blog post is for general informational purposes only and does not constitute legal advice. Cockroach Labs makes no representations or warranties regarding the accuracy, completeness, or timeliness of the information contained herein, and expressly disclaims any liability arising from reliance on such content.

This post provides a general overview of the RBI Guidelines on Information Security, Electronic Banking, Technology Risk Management, and Cyber Frauds, highlighting key mandates within the framework and explaining how CockroachDB, a distributed SQL database, with its advanced security and resilience features, can help your organization meet these requirements and strengthen its overall technology risk posture.

The Reserve Bank of India (RBI) has always been serious about keeping India’s banking system safe and resilient. And with the explosion of online payments, mobile banking, and real-time Unified Payments Interface (UPI) transactions, the pressure is higher than ever. One slip — a cyberattack, a major outage, or a fraud — and millions of customers feel the impact instantly.

That’s why the RBI rolled out its Guidelines on Information Security, Electronic Banking, Technology Risk Management, and Cyber Frauds. Think of it less as a boring compliance checklist and more as a playbook for modern banking. What really sets these guidelines apart? They don’t stop at firewalls and passwords; they put senior executives and corporate boards directly on the hook for IT governance and cybersecurity. In other words, leadership can’t just hand this off to the IT team and walk away.

And who needs to care about this? All banks in India, whether public, private, foreign, or cooperative. But the scope doesn’t end there. NBFCs, payment institutions, and other RBI-regulated players in the financial ecosystem are expected to pay close attention too. If you’re handling customer data and digital transactions, these rules likely apply to you.

For leaders across the financial sector, these guidelines aren’t just about checking a regulatory box. They’re a blueprint for building trust in the digital age, where customers want their banks and financial partners to protect not only their money but also their data, identity, and access every single time they log in.

Objectives of the RBI Guidelines

The RBI’s guidelines are all about making India’s financial ecosystem secure, resilient, and customer-first.

Here’s what the guidelines aim to achieve:

Strengthen IT governance by holding boards and senior management personally accountable for technology risk.

Protect customer data and privacy with stronger information security frameworks.

Keep the lights on through resilient IT operations and disaster recovery planning.

Stay ahead of fraudsters with real-time monitoring and dedicated fraud management units.

Build trust and transparency with independent audits and customer education.

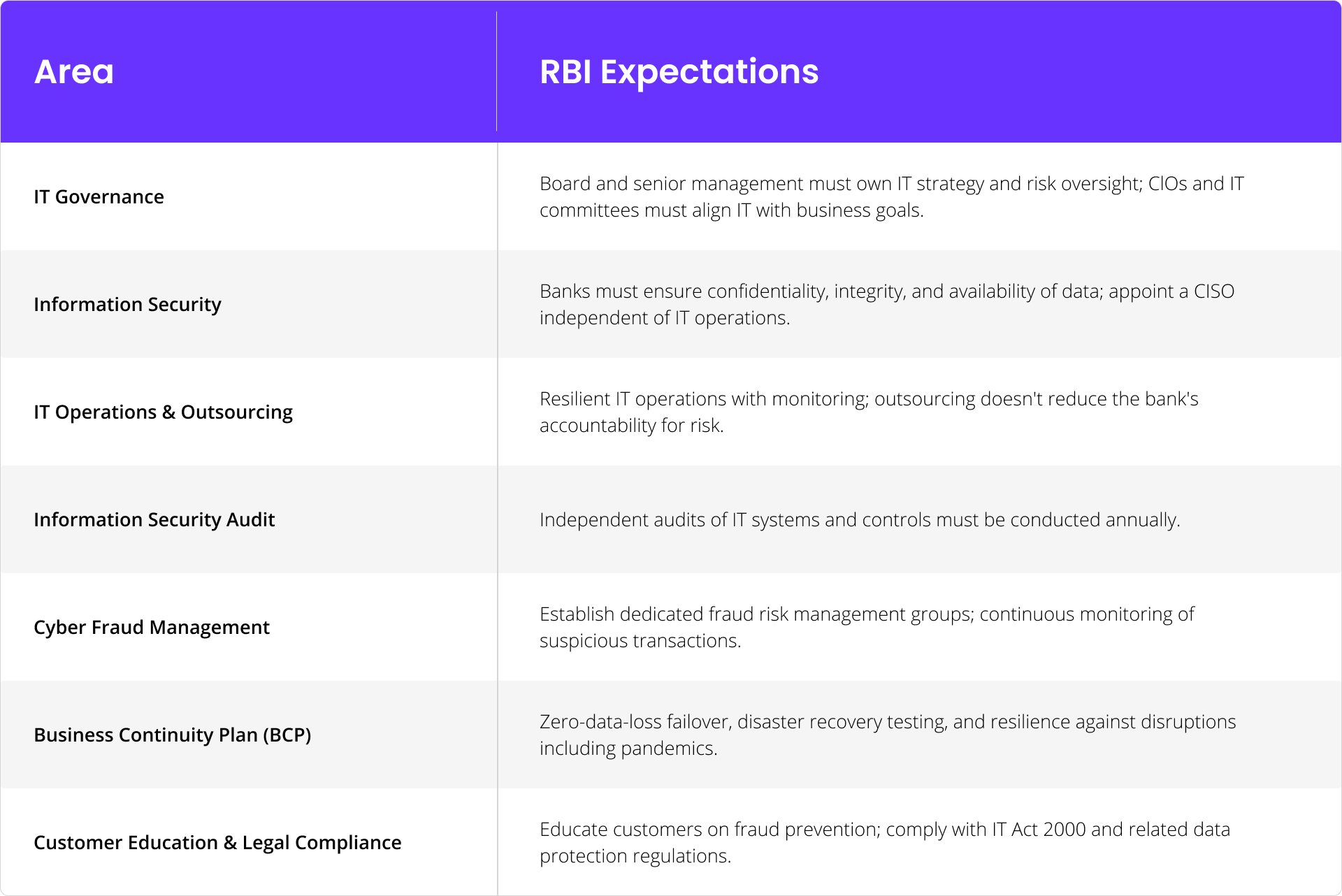

Key Areas Covered in the RBI Guidelines

The RBI framework spans nine chapters, with detailed prescriptions for governance, operations, and controls. Some of the most critical areas include:

The Compliance Challenge for Banks

Meeting RBI’s expectations is not just about policies on paper — it requires modern, resilient technology infrastructure. Each mandate comes with its own set of challenges:

Data residency and localization

RBI requires banks to keep sensitive customer data within India.

The challenge: Global and legacy systems often struggle to guarantee strict data residency without adding complexity.

Always-on operations

RBI requires uninterrupted services with minimal downtime.

The challenge: Legacy infrastructure makes 24/7 availability difficult with both planned and unplanned downtime arising from “business as usual” operations, raising both customer frustration and regulatory risk.

Fraud detection and real-time response

RBI requires proactive fraud monitoring and timely incident response.

The challenge: Outdated platforms can’t always process and analyze transactions at scale, leaving blind spots.

RELATED

"Building Fraud Detection Systems at Scale with Cockroach Labs and AWS," stream the webinar on-demand today.

Hear from Peter Williams, Global Head of Financial Services Partner Technology at AWS to learn more about why financial institutions trust CockroachDB on AWS.

Audit readiness

RBI requires clear audit trails to prove compliance.

The challenge: Siloed or manual logging makes it expensive and slow to demonstrate compliance.

Vendor risk management:

RBI requires that banks remain accountable even when outsourcing IT services.

The challenge: Many institutions lack visibility and control over third-party systems, creating compliance gaps.

How CockroachDB Helps Banks Align with RBI Guidelines

CockroachDB’s architecture was designed for resilient, regulated workloads. Below is a quick mapping of RBI guideline areas to CockroachDB capabilities:

Get the guide

Download From Resilience to Scalability: 12 Mission-Critical CockroachDB Use Cases and learn what running the world’s most resilient database can do for your apps, your users, and your business.

From Compliance to Competitive Advantage

The RBI’s guidelines definitely raise the bar for India’s entire banking ecosystem. And sure, on the surface they might feel tough to keep up with, but for forward-looking banks, they’re actually a huge opportunity. It’s a chance to bake security and resilience right into the core of your systems and stand out by building the kind of trust customers really care about.

That’s where CockroachDB comes in. Its distributed, resilient, transactionally consistent design makes it easier to meet RBI’s requirements without slowing down innovation. Banks can stay compliant and still deliver the scale, speed, and agility needed to serve millions of always-on, digital-first customers.

Compliance with RBI’s technology and security guidelines is no longer optional; it is a business imperative. The cost of failure includes not only penalties but also the erosion of customer confidence.

CockroachDB enables banks to meet RBI’s expectations by design:

Resilient operations with continuous availability.

Data governance with native declarative data placement.

Secure data handling with encryption and RBAC.

Audit-ready infrastructure with built-in logging.

Compliance-friendly architecture with data residency controls.

By adopting CockroachDB, banks can move beyond reactive compliance to proactive trust-building, ensuring their systems are prepared for the next decade of India’s digital banking growth.

Try CockroachDB Today

Spin up your first CockroachDB Cloud cluster in minutes. Start with $400 in free credits. Or get a free 30-day trial of CockroachDB Enterprise on self-hosted environments.

About the authors

Biplav Saraf is Staff Product Manager for Cockroach Labs.

Mike Geehan is Head of Security for Cockroach Labs.

Ayog Mohanty is Senior Compliance Analyst for Cockroach Labs.