CASE STUDY

Expanding across the globe: Banking and payments at hyperscale

Pismo is using CockroachDB to expand their cloud-native digital banking platform to new regions and new customers

30+ million accounts

5 years of development

7+ billion API requests/month

9 nodes across 3 regions

10 engineers

USD 4+ billion TPV

About Pismo

Financial innovation is more than just a cool UI. It calls for an end-to-end platform that is highly customizable, lives in the cloud, and has a back-end solution to match the advanced technology deployed at the front-end.

Pismo is the first digital banking and payments processor with a fully multi-cloud SaaS platform that helps financial institutions overhaul their core processing systems, improve efficiency, and accelerate time to market. Pismo delivers a complete solution for card issuing, digital accounts, wallets, sellers’ management, and other next-gen payment platforms.

The company was founded in 2016 by Ricardo Josuá (CEO), Daniela Binatti (CTO), Juliana Motta (CPO), and Marcelo Parise (VP of Engineering). With 20+ years of experience in the industry, and after 16+ years building a core processing system from scratch, they launched Pismo to unleash a new era of banking and payments.

Now they serve customers such as Banco Itaú (the largest retail bank in Brazil) and BTG Pactual (the largest investment bank in Brazil) and have their sights set on international expansion. The company is currently running 2+ million onboardings per month and has over 30+ million accounts.

In order to expand their business to new regions, the Pismo team needed to build their platform on a resilient, cloud-native, and scalable foundation. These requirements ultimately led them to CockroachDB.

“We process the demand load across several regions worldwide using distributed systems running on top of Kubernetes. We rely on several technologies that allow us to operate a horizontally scalable platform and CockroachDB strengthens our resilience.” - Daniela Binatti, Co-Founder and CTO

Challenges & Requirements

Large banks and fintech companies rely on Pismo’s platform to manage their core banking operations, and that’s a huge responsibility. Prior to using CockroachDB, Pismo built their asset registration service on another relational database, but they were not pleased with its performance.

The CTO, Daniela Binatti, created a task force of 10 engineers who were assigned to develop a multi-region, active-active version of the platform.

The engineers’ ultimate goal was to improve the resilience of their solution. They also needed a platform that would allow them to expand to additional regions across the globe while adhering to data storage regulations.

In summary, their requirements for a new database included:

Cloud-native database with an option to span across multiple clouds

Horizontally scalable solution

Ability to tie data to a location

High-level of consistency for sensitive data

Resilient, highly available foundation

The team came across CockroachDB when searching for a horizontally scalable database. And then they found that there was a lot more CockroachDB could offer, including a managed service, CockroachDB Dedicated.

“When building Pismo, we wanted to leave behind all the artifacts of an industry that still largely operates on decades-old infrastructure. Most banks are working with obsolete solutions. Not us. With CockroachDB we are able to build a cloud-native solution that will scale with our success.” - Daniela Binatti, Co-Founder and CTO

A scalable, distributed solution

After testing CockroachDB, the team found that it could increase resilience/survivability, consistency, and performance. Additionally, it provided all the necessary functionality needed to span across multiple cloud providers.

As a result, Pismo migrated their asset registration, custody, and management services to CockroachDB which serves as a system of record. With CockroachDB, the platform is able to support intense loads of create, read, update, delete (CRUD) operations, in particular when performing asset registrations and daily accruals. This data consists of fixed income debt instruments, and a vast amount of financial data such as rates, transactions, and redemptions.

The platform provides registration, management, and interest accrual for financial assets through a set of Restful APIs and related event-based background workers. Pismo’s platform is registering over 7 billion API requests per month. In comparison, the total Open Banking requests in the UK are only around 800 million per month.

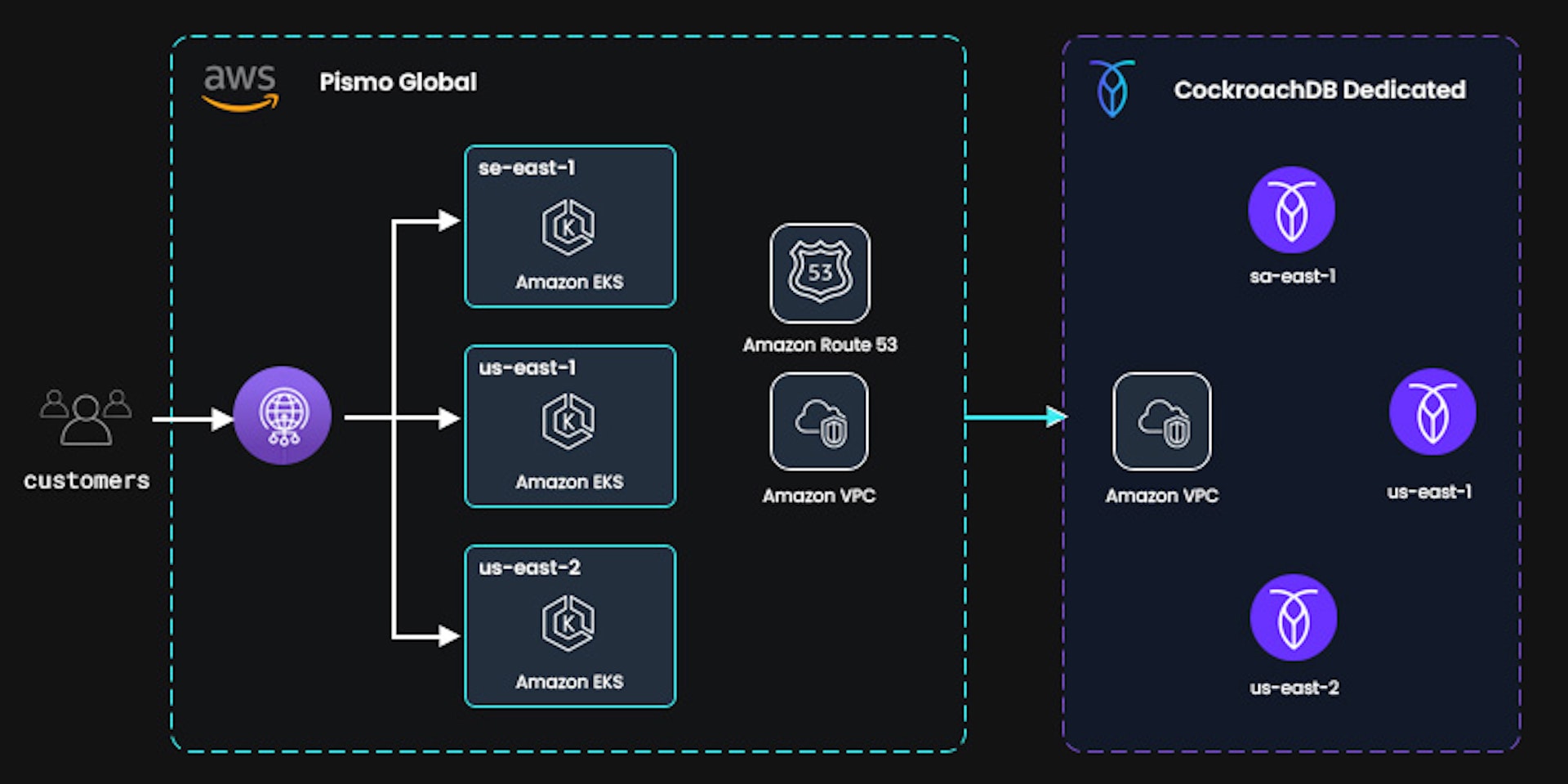

As Pismo expands globally, they need to be ready to deploy anywhere while respecting the legal obligations of data storage. Given these requirements, they are deploying CockroachDB Dedicated on Kubernetes to achieve horizontal scale and distribution. They are hosting via AWS with plans to add regions on other cloud providers in the future.

Currently, they have installations of the platform running in three regions in AWS US-East-1, US-East-2, and SA-East-1. For their production environment, they are set up with a total of 9 nodes (3 in each region) with 4vCPUs each. They also have a dev environment with a total of 3 nodes with 2vCPUs each.

CockroachDB Dedicated gives Pismo the ability to delegate the operational overhead of managing a database to the Cockroach Labs SRE team. They report that this allows the team to focus on developing their application and platform while leveraging Cockroach Labs’ expertise to handle the database operations.

Expanding to new regions

Pismo is an engine for large banks and financial companies. With the cloud, it is possible for them to process an infinitely greater volume of operations with the richness of data and speed. Their offering is unique because it is truly cloud-native and delivers the flexibility and scalability required by their customers.

They have several LATAM customers in production and now they are expanding their international presence. Their next step is to add an additional region in EMEA to service and onboard customers within the EU. The data will be pinned to the EMEA region and written in European nodes. In October 2021, Pismo raised $108 million Series B led by SoftBank, Amazon and Accel to enable cloud-native financial services globally. With this expansion, Pismo is accelerating its journey to becoming the world’s leading banking and payments platform.